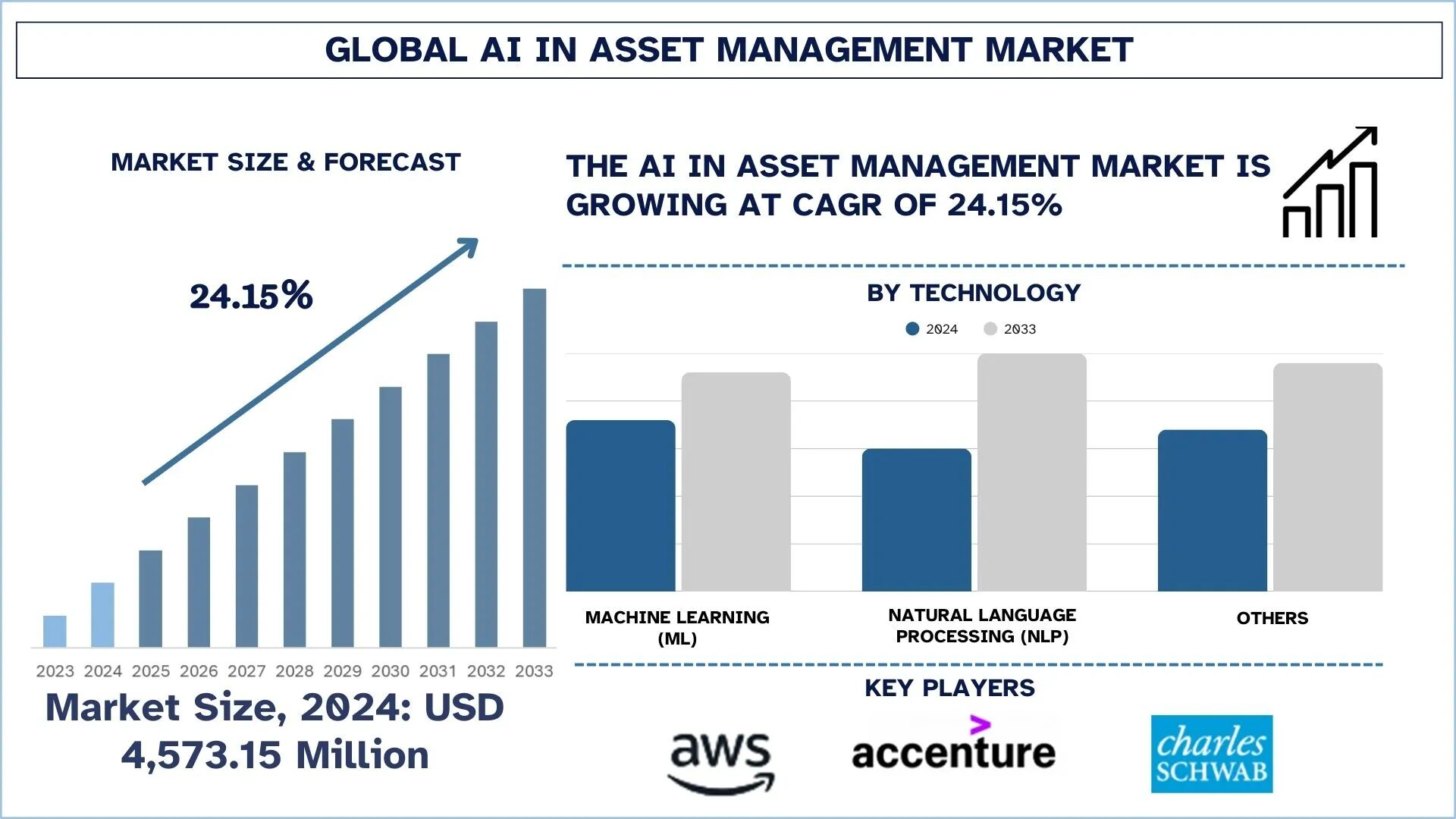

According to UnivDatos, the growing need for data-driven investment decisions and increasing demand for automation and cost optimization are the major factors driving the growth of AI in the Asset Management market. As per their “AI in Asset Management Market” report, the global market was valued at USD 4,573.15 million in 2024, growing at a CAGR of about 24.15% during the forecast period from 2025 – 2033 to reach USD million by 2033.

Artificial Intelligence in Asset Management is the application of emerging technologies like machine learning, natural language processing, and predictive analytics to promote investment in the decision-making process, portfolio management, risk assessment, and operational efficiency. The AI systems are evaluating large amounts of both structured and unstructured data, consisting of market trends, financial statements, and other alternative sources of data, to create actionable insights and predictions. These technologies allow the asset managers to automate the trading strategies, to optimize the allocation of assets, to identify anomalies in the market, and to personalize the solutions to the investment.

Increased Collaboration between Asset Managers and Fintech/AI Startups

Enhanced collaboration between asset managers and fintech or AI start-ups will be one of the key trends of the Artificial Intelligence in Asset Management market as conservative companies seek to accelerate the rate of innovation and remain viable in a rapidly evolving financial landscape. Fintech and AI startups allow the asset managers to embrace the best in machine learning, data science, cloud-based environment, and alternative data analytics without necessarily creating them in-house in the long term. The asset management companies can quickly adopt the emerging AI functionalities through partnerships, joint ventures, or acquisitions in their portfolio management, risk modelling, client engagement, and compliance functions. New business models, such as robo-advisory platforms and personalized solutions to investments, are also tested as a result of such partnerships. As the regulatory environment gets more and more complicated and the amount of data grows, collaborations with agile technologies can enable asset managers to get more efficient in their operations, reduce costs, and provide a more responsive and technology-centered approach to investment to clients.

For instance, in November 2025, Franklin Templeton entered into a multi-year strategic partnership with Wand AI to advance the adoption of agentic artificial intelligence across its asset management operations. The collaboration focused on enhancing investment research, portfolio construction, and decision-making capabilities through advanced AI-driven workflows and automation.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/artificial-intelligence-in-asset-management-market?popup=report-enquiry

Rising Adoption of AI Driven by New Product Launches and Platform Innovations

The introduction of new products is increasing the pace of AI in the Asset Management market around the world, with innovative and scalable as well as user-friendly AI offerings to meet the growing demands of investments. Technology providers are introducing new platforms that improve the optimization of the portfolio, real-time analytics, risk management, and automated decisions. These launches help asset managers to embrace AI more effectively without the need to spend a lot on infrastructure. Due to the intensified competition, the regular upgrades of the product and high-functioning AI solutions aid companies in distinguishing their products, stimulating market penetration, and increasing the use of AI throughout the world.

For instance, in September 2025, SPLX launched its new AI Asset Management solution, expanding its platform to help enterprises map, monitor, and secure every component of their AI stack with features like AI model inventories, vulnerability scanning, and agentic workflow analysis. This enterprise-grade offering aimed to give security and engineering teams greater visibility and risk insight across AI systems, enhancing their ability to adopt agentic systems more securely.

Innovation, Strategic Collaborations, and Product Launches Driving Growth in the AI in Asset Management Market

Innovation in AI in the asset management market is accelerating as asset managers and fintech or AI startups collaborate, enabling them to adopt more sophisticated technologies and develop new investment models. At the same time, the increase in new product launches and platform innovations is enhancing the use of AI because they provide scalable, cost-effective, and easy-to-use solutions to optimize the portfolio, analytics, risk management, and market penetration.

Related Reports:-

Artificial Intelligence Market: Current Analysis and Forecast (2025-2033)

Artificial Intelligence Prompt Marketplace Market: Current Analysis and Forecast (2025-2033)

Asset and Wealth Management Market: Current Analysis and Forecast (2022-2028)

Adaptive AI Market: Current Analysis and Forecast (2024-2032)

AI in Manufacturing Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number – +1 978 733 0253

Email – contact@univdatos.com

Website – www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/